Turning up the heat – life & health insurers learn to adapt

The risks posed by rising global temperatures are usually thought of in a property and casualty insurance context. But life and health carriers also need to prepare their businesses for a much hotter world, says Steven Chen, partner at Boston Consulting Group.

The potential health effects of global heating are attracting increasing attention from life and health (L&H) insurers. According to a recent report from industry body the Geneva Association, acute health risks affecting mortality and morbidity trends include respiratory problems from wildfires, and strokes from heat waves. Rising temperatures also extend the range of disease-carrying insects, the report says.

Elsewhere, new research from the University of Manchester and Friends of the Earth, warns that existing conditions such as diabetes, kidney disease and rheumatoid arthritis are exacerbated by high temperatures.

Boston Consulting Group’s Steven Chen says climate change could cause adverse impacts from physical hazards such as flood, wind, wildfire and heat. “These could then lead to heat-related illness, vector-borne diseases, reduced air quality, malnutrition, etc., which would have impacts on mortality and morbidity for L&H carriers,” he explains.

“The degree of the impact would vary by regions and countries. For example, in China, from a mortality perspective, reduced air quality has the highest impact based on World Health Organisation (WHO) studies. On the other hand, from a morbidity perspective, malnutrition has one of the highest impacts.”

The risks garnering most attention from L&H insurers, however, are heat-related disease, reduced air quality and vector-borne disease:

“Insurers are actively working with government and health organisations to collect data and develop studies on the health impacts.”

“The challenge is to attribute the excess impact in mortality and mortality to climate changes – which is still a work in progress.”

Chen notes that studies available today are mostly on the general population, not on the insured population: “So insurers also need to take their own insured mortality and morbidity experience and product features into consideration.”

Insurtech opportunities

L&H insurers can prepare for the worsening impact of climate change on human health and longevity – and technology will play a role, Chen says. He envisages an ecosystem developing as insurers forge partnerships to better underwrite climate-related risks: “These partners can be third-party data providers or new technology vendors. Advanced AI solutions could leverage geo-location physical hazard data to assess climate-related risks.”

Uncertainties around climate change risk present a significant difficulty, Chen says: “One of the main challenges is data. For example, there are questions about how the physical hazard risks would evolve over the next 20–30 years and how they might vary by different climate scenarios.

“Insurers could work with insurtechs on plugging the data gaps needed to advance climate considerations in analytics and underwriting decisions.”

Risk – and opportunity

It’s worth remembering that risk and opportunity tend to go hand-in-hand, Chen stresses:

Such as dengue fever, for example. These would require insurers to develop new propositions to meet the market demand.”

According to the Geneva Association’s report, parametric insurance, facilitated by insurtech solutions, is another source of product development. With parametric models, payouts are triggered when specific, measurable and predetermined criteria such as heat or pollution levels are met.

Chen says that some pioneering moves to introducing parametric products have already been made, including heatwave insurance in Hong Kong to protect outdoor workers when the temperature stays above 36 degrees for three consecutive days in the period from August to October.

Insurers should not overlook the complexity of the “go-to-market” aspect of providing heat-related products and they should play a proactive role in the marketing and distribution of their propositions, Chen suggests:

“There is an old saying that insurance is sold not bought. I feel climate-related risk also falls into that bucket.”

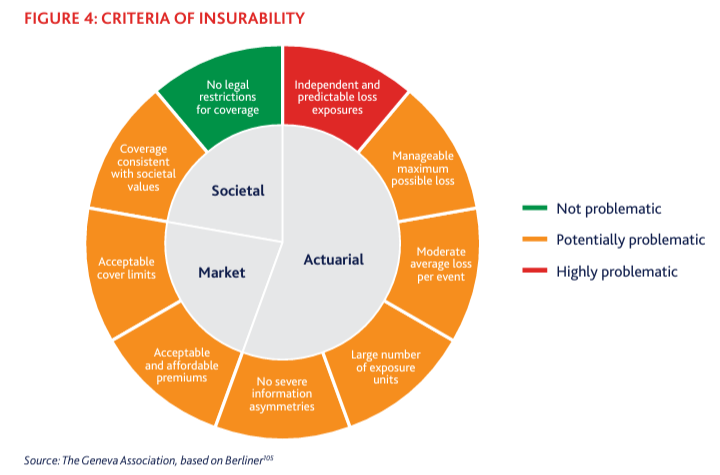

A recent research report from the Geneva Association used feedback from global L&H insurance companies on how they experience and view the impact of climate change on health to produce an insurability framework for climate-related health risks.

Most interviewees do not perceive climate change as exerting any immediate impact on the liabilities associated with L&H insurance products, nor do they anticipate short-term consequences for their insurability and affordability. But there is consensus that this might change due to the increasing scale, intensity and frequency of climate events, particularly with global temperatures likely to surpass the 1.5 °C threshold by 2027.

User questions

Answered questions

Unanswered questions

Views: 547

Downloads: 0

| 0 % | |

| 0 % | |

| 0 % | |

| 0 % | |

| 0 % |

Page is favored by 0 user.

Contact inquiries: 0